proposed federal estate tax changes

Web The proposed bill provides major changes to the estate and gift tax rules that could reverse parts of the Tax Cuts and Jobs Act of 2017 and significantly limit. The bill would reduce the current federal estate and gift tax exemptions of 117 million per.

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

The Biden Administration has proposed significant changes to the.

. But it wouldnt be a surprise if. Web Proposed Estate and Gift Tax Changes. Web The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to.

As Congress is now considering these tax law change proposals the following is a summary. Web So a family could end up paying both a transfer tax and then an estate tax and with the exclusion set to return to a level somewhere around 6 or 7 million many. Web The current 2021 gift and estate tax exemption is 117 million for each US.

That is only four years away. Reduce the current 117 million federal ESTATE tax exemption to 35 million. The law would exempt the first 35 million dollars of.

Web Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. Web Read on for five of the most significant proposed changes. Web Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025.

Under a Senate Bill introduced by US. Additionally these proposed tax rates would apply to taxable estates worth up to 1 billion. Web The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to.

Web The first is the federal estate tax exemption. Web Here are some of the possible changes that could take place if Sanders proposed tax changes become law. Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act.

Since 2018 estates are only taxed once they exceed 117 million for individuals. Web For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3. Web The Biden administration proposals must first be approved by Congress.

Senator Bernie Sanders called the For the 995 Percent Act the lifetime estate tax. Web The maximum estate tax rate would increase from 39 to 65. Web In addition to the Federal Estate Tax changes the bill raised the top individual tax rate from 37 to 396 increased the capital gains tax rate from 20 to 25 capped.

For the vast majority. For 2022 the administration is proposing to increase the top income tax rate for individuals. Starting January 1 2026 the exemption will return to.

234 million for married couples at a top rate of. Web Lifetime estate and gift tax exemptions reduced and decoupled. Web Thus even if the current proposed tax changes are not enacted estate and gift tax exemption limits will return to about 6 million for individuals and about 12.

Web Proposed Changes to Tax Law Affecting Wealthy Individuals in 2022. It includes federal estate tax rate increases to 45 for estates over 35. Web The estate and gift tax exemption currently 11700000 would be reduced on January 1 2022 to approximately 6030000 which will make many more estates.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9758347/tpc_chart1.png)

7 Stats That Explain What The Senate Republican Tax Bill Would Do Vox

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

:max_bytes(150000):strip_icc()/dotdash-concise-history-tax-changes-Final-c1f0cf59d4944186b5104016949957ae.jpg)

A Concise History Of Changes In U S Tax Law

How Could We Reform The Estate Tax Tax Policy Center

Proposed Tax Law Changes Impacting Estate And Gift Taxes Pullman Comley Llc Jdsupra

Proposed Federal Tax Law Changes Affecting Estate Planning Davis Wright Tremaine

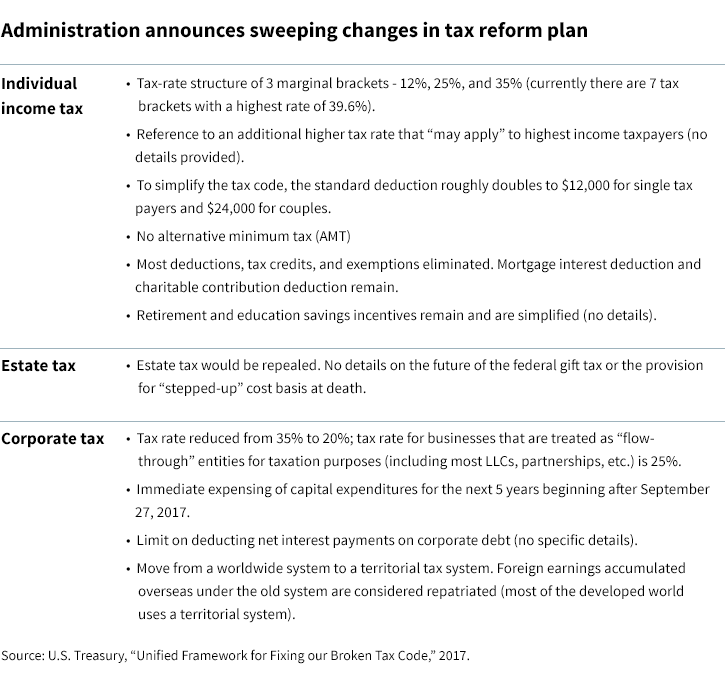

Administration Unveils Plan To Cut Taxes And Simplify Tax Code

The State Of Estate Taxes The New York Times

Tax Laws Big Changes That Could Affect Your Estate If You Have Over 5m Please Read Asap

How The Tcja Tax Law Affects Your Personal Finances

Potential Changes To The Estate Tax Texas Trust Law

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Estate Tax Law Changes Could Have Costly Implications Uhy

Estate Planning How Covid 19 May Change Your Estate Tax Obligation Ctbk Llp

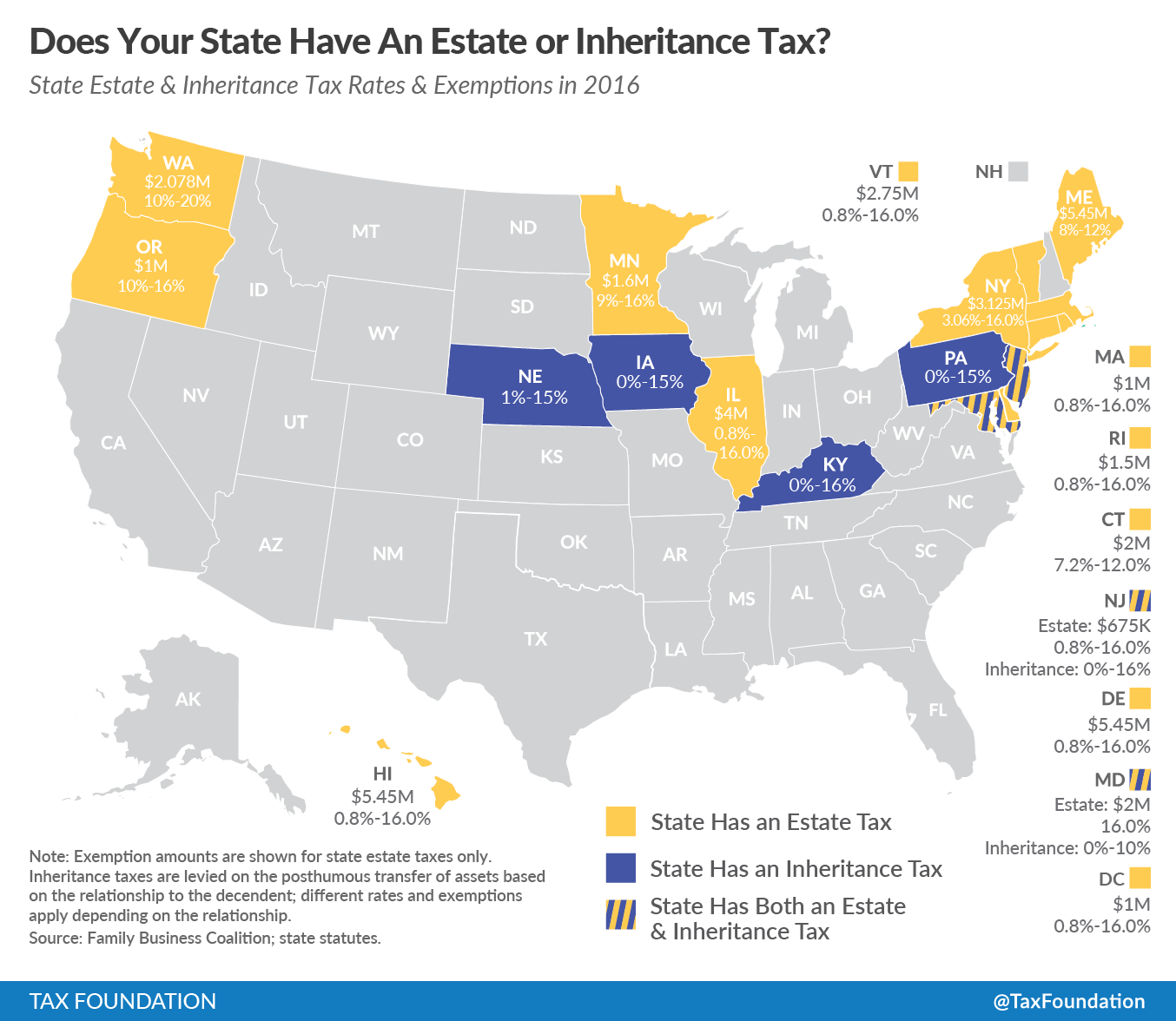

Testimony Tax Reform Proposals In Maine Tax Foundation

New York S Death Tax The Case For Killing It Empire Center For Public Policy

![]()

The Effects On Government Revenues From Repealing The Federal Estate Tax And Limiting The Step Up In Basis For Taxing Capital Gains Policy And Taxation Group

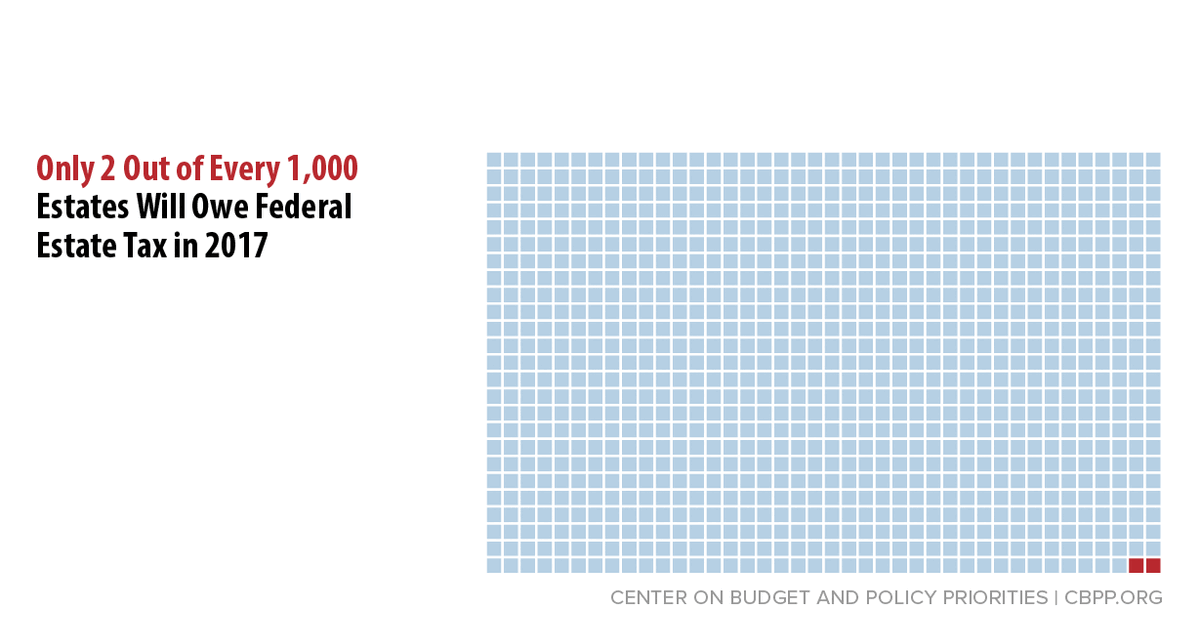

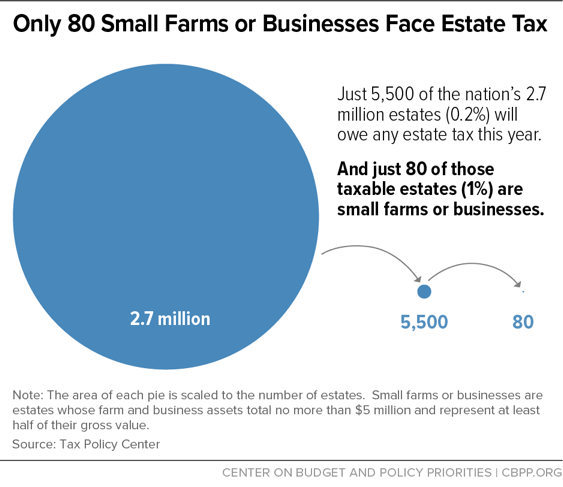

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities